fancyrobot.site

Prices

What Is Fvrr Stock

The current price of FVRR is USD — it has increased by % in the past 24 hours. Watch Fiverr International Ltd. stock price performance more closely on. A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. M USD. Avg Volume. The average number of. See the company profile for Fiverr International Ltd. (FVRR) including business summary, industry/sector information, number of employees, business summary. FVRR - Fiverr International Ltd. Stock - Stock Price, Institutional Ownership, Shareholders (NYSE). See the company profile for Fiverr International Ltd. (FVRR) including business summary, industry/sector information, number of employees, business summary. Key Stock Data · P/E Ratio (TTM). (08/20/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. FVRR. Fiverr International Ltd. develops an e-commerce platform that allows the people to buy and sell digital services. It operates through the following. Stock Predictions · Is Fiverr International stock public? Yes, Fiverr International is a publicly traded company. · What is the Fiverr International stock quote. Fiverr International Ltd. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, N/A. The current price of FVRR is USD — it has increased by % in the past 24 hours. Watch Fiverr International Ltd. stock price performance more closely on. A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. M USD. Avg Volume. The average number of. See the company profile for Fiverr International Ltd. (FVRR) including business summary, industry/sector information, number of employees, business summary. FVRR - Fiverr International Ltd. Stock - Stock Price, Institutional Ownership, Shareholders (NYSE). See the company profile for Fiverr International Ltd. (FVRR) including business summary, industry/sector information, number of employees, business summary. Key Stock Data · P/E Ratio (TTM). (08/20/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. FVRR. Fiverr International Ltd. develops an e-commerce platform that allows the people to buy and sell digital services. It operates through the following. Stock Predictions · Is Fiverr International stock public? Yes, Fiverr International is a publicly traded company. · What is the Fiverr International stock quote. Fiverr International Ltd. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, N/A.

Freelancer marketplace Fiverr is trading at 36 times expected fiscal revenue. It's a 'rare-air premium valuation,' MKM says, cutting the stock to sell. Get the latest updates on Fiverr International Ltd. Ordinary Shares, no par value (FVRR) after hours trades, after hours share volumes, and more. Real-time Price Updates for Fiverr International Ltd (FVRR-N), along with buy or sell indicators, analysis, charts, historical performance, news and more. Fiverr International Ltd. operates an online marketplace worldwide. Its platform enables sellers to sell their services and buyers to buy them. Fiverr International Company Info. Fiverr's online platform connects freelance workers with potential clients. News & Analysis. Financial Health. General. 21 minutes ago. Track Fiverr International Ltd (FVRR) Stock Price, Quote, latest community messages, chart, news and other stock related information. FVRR Stock Overview Operates an online marketplace worldwide. High growth potential with adequate balance sheet. Data Learn. Track Fiverr International Ltd (FVRR) Stock Price, Quote, latest community messages, chart, news and other stock related information. (NYSE: FVRR) Fiverr's forecast annual earnings growth rate of % is forecast to beat the US Internet Content & Information industry's average forecast. Discover real-time Fiverr International Ltd. Ordinary Shares, no par value (FVRR) stock prices, quotes, historical data, news, and Insights for informed. Stock analysis for Fiverr International Ltd (FVRR:New York) including stock price, stock chart, company news, key statistics, fundamentals and company. - FVRR Stock was down % · Fiverr (FVRR) saw a strong bearish movement possibly linked to concerns or lower-than-expected performance in its Q1. See the latest Fiverr International Ltd stock price (FVRR:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Find out the current price target and stock forecast for Fiverr International (FVRR). View the FVRR premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Fiverr International. FVRR - Fiverr International Ltd - Stock screener for investors and traders, financial visualizations. See FVRR stock price and Buy/Sell Fiverr. Discuss news and analysts' price predictions with the investor community. FVRR, Fiverr International - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. Fiverr International Ltd. Registered ShsStock, FVRR ; Balance Sheet in Mio. USD · Total liabilities, ; Key Data in USD · Sales per share,

Will Price Of Homes Go Down In 2022

Of course, such price gains will push homeownership out of the reach of many Meanwhile, the rate of house price appreciation should start to come back down to. houses and a green arrow down. The concept of low cost real estate. Real homes that can be grouped together for meaningful statistical reporting. Prices will relax, but not crash. Prices have relaxed in Texas and gone down slightly in many cities, but you should expect prices to go up some in The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting. The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting. Rates will go back down to by the end of That's nearly the same as Redfin's prediction. Single family home construction will be at its lowest since. As more buyers enter the market, the demand for housing increases in turn. And if there remains a limited supply of housing inventory, prices in a low interest. Housing activity for both new and existing homes decreased considerably in June. Growth in active listings resulted in downward pressure on home prices. Will Home Prices Go Down in ? · Home prices generally decrease when mortgage prices increase. · The average mortgage rate is % as of August · The. Of course, such price gains will push homeownership out of the reach of many Meanwhile, the rate of house price appreciation should start to come back down to. houses and a green arrow down. The concept of low cost real estate. Real homes that can be grouped together for meaningful statistical reporting. Prices will relax, but not crash. Prices have relaxed in Texas and gone down slightly in many cities, but you should expect prices to go up some in The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting. The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting. Rates will go back down to by the end of That's nearly the same as Redfin's prediction. Single family home construction will be at its lowest since. As more buyers enter the market, the demand for housing increases in turn. And if there remains a limited supply of housing inventory, prices in a low interest. Housing activity for both new and existing homes decreased considerably in June. Growth in active listings resulted in downward pressure on home prices. Will Home Prices Go Down in ? · Home prices generally decrease when mortgage prices increase. · The average mortgage rate is % as of August · The.

Select a date that will equal for your custom index: U.S. recession Move down. Data in this graph are copyrighted. Please review the copyright. Hi Krystal, you can buy shares in rental properties in the Southeast through Arrived Homes. Over time, I know I'll come out ahead, without trying to time the. Select a date that will equal for your custom index: U.S. recession Move down. Data in this graph are copyrighted. Please review the copyright. This is a year-over-year increase of nearly 17%. Graph of housing stats in Nashville during January As for the past 5 years, the median price of a single-. In July , % of homes in the U.S. sold above list price, down points. Prices of new homes have been falling, and some homebuyers might find they will have paid much more than the more recent buyers in their development. Based on. Whatever the phase of the cycle, up or down, while it is going on people think it will last forever. out when peak prices are hit. The lowest Bay Area. houses and a green arrow down. The concept of low cost real estate. Real homes that can be grouped together for meaningful statistical reporting. Get the latest data. Read the news release. Concept illustration of a real estate yard sign with up and down arrows · Existing-Home Sales Housing Snapshot. The average United States home value is $,, up % over the past year and goes to pending in around 15 days. What is the Zillow Home Values Index? Zillow. Homes in San Antonio have sold for % less than they did a year ago. Summary: The median home sold price in San Antonio was $, in August , down %. Housing Market News · Housing Market Predictions A Post-Pandemic Sales Slump Will Push Home Prices Down For the First Time in a Decade. 06 Dec, You might have fewer homes to choose from in the winter, but you'll be more likely to have an offer accepted when there's less competition from other buyers. New listings tend to jump in April as move-up buyers enter the market. However, as supply usually reaches its lowest point in February, inventory will continue. However, an expert from Zoopla predicted house prices would fall by 22% by Ultimately, because the market is "complex" it is "difficult to predict with. This is a year-over-year increase of nearly 17%. Graph of housing stats in Nashville during January As for the past 5 years, the median price of a single-. Meanwhile, Freddie Mac believes house prices will increase at a slower pace of % in , down from % in versus the year prior. When it comes to. The Portland real estate market since the first half of is down, home prices are down a median average of % from mid to mid House price predictions · Property website Rightmove anticipates a modest 1% fall in house prices by the end of · Property website Zoopla is also.

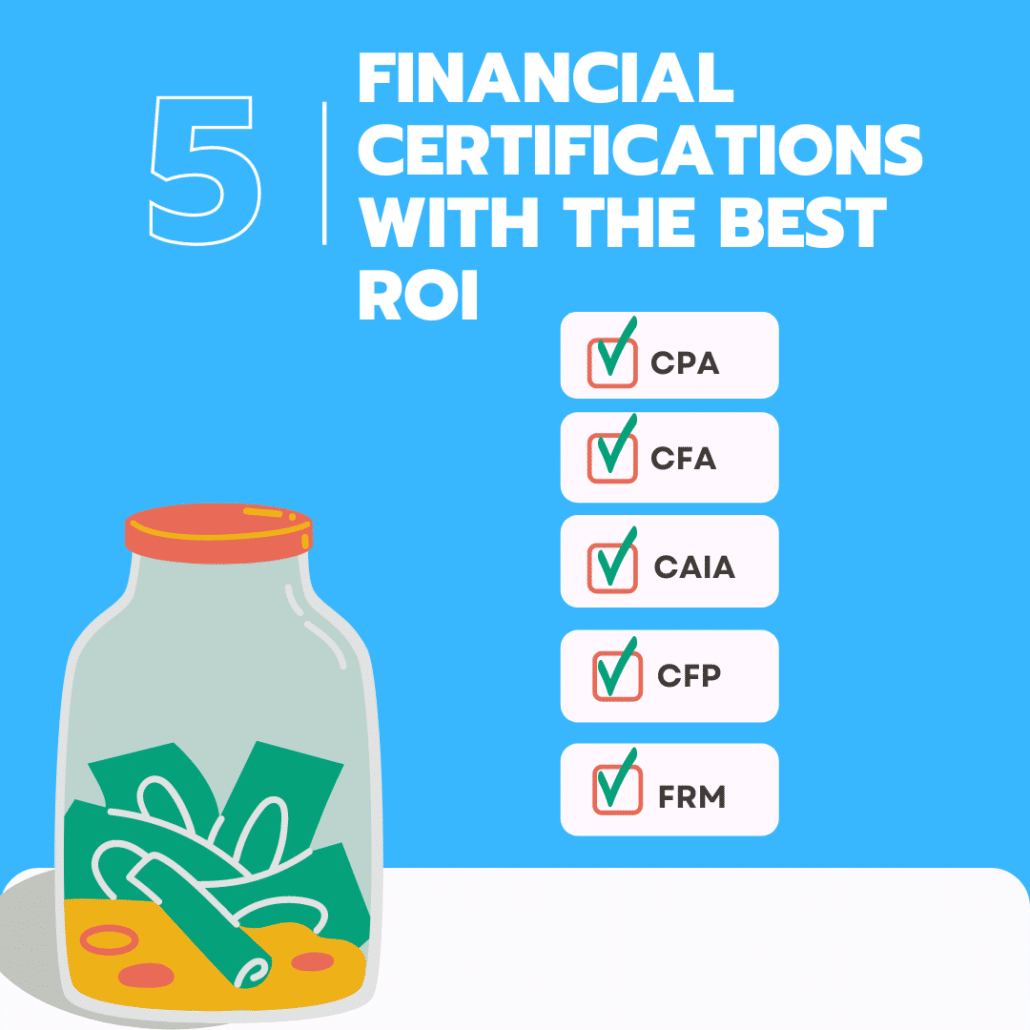

Most Prestigious Financial Certifications

What's the best financial advisor certification to advance your career? Learn how professional designations for financial advisors, wealth managers. Here is a list of the most important series exams for your financial and investing career: Series 6 – Investment Company and Variable Contracts Products Rep. Best Financial Analyst Certifications · Certified Management Accountant (CMA) · Financial Risk Manager (FRM) · Chartered Alternative Investment Analyst (CAIA). The CFP® mark is the best-known credential for financial planning professionals. According to a recent study of CFP® professionals, 85% of respondents are very. CFP® certification is the most trusted designation in the financial planning profession. If you are trying to plan your career in Finance, the two most popular currently are Series 7 and Chartered Financial Analyst, which will open a lot of doors if. Certified Financial Planner (CFP) designation -- Good if you want to be a financial advisor. Financial Risk Manager (FRM) certification The only time CFP is more relevant is when one wants to become a financial planner. The CFA is respected in the asset management, equity. 6 Best Financial Certifications That Have the Best ROI · 1. Certified Public Accountant (CPA) · 2. Chartered Financial Analyst (CFA) · 3. Chartered Alternative. What's the best financial advisor certification to advance your career? Learn how professional designations for financial advisors, wealth managers. Here is a list of the most important series exams for your financial and investing career: Series 6 – Investment Company and Variable Contracts Products Rep. Best Financial Analyst Certifications · Certified Management Accountant (CMA) · Financial Risk Manager (FRM) · Chartered Alternative Investment Analyst (CAIA). The CFP® mark is the best-known credential for financial planning professionals. According to a recent study of CFP® professionals, 85% of respondents are very. CFP® certification is the most trusted designation in the financial planning profession. If you are trying to plan your career in Finance, the two most popular currently are Series 7 and Chartered Financial Analyst, which will open a lot of doors if. Certified Financial Planner (CFP) designation -- Good if you want to be a financial advisor. Financial Risk Manager (FRM) certification The only time CFP is more relevant is when one wants to become a financial planner. The CFA is respected in the asset management, equity. 6 Best Financial Certifications That Have the Best ROI · 1. Certified Public Accountant (CPA) · 2. Chartered Financial Analyst (CFA) · 3. Chartered Alternative.

Below is an extensive list of the most important financial certifications that will help you in your business or finance career. Top 5 accounting and finance certifications · 1. Certified Government Financial Manager · 2. CMA · 3. CPA · 4. Chartered Financial Analyst (CFA) · 5. Enrolled Agent. Find the best and highest paying Finance Analyst certifications and their requirements. These are the most important certifications to advance in your. Several certifications and certificates are available to demonstrate proficiency in financial analytics. These include the Chartered Financial Analyst (CFA). The Top 10 Finance Certifications To Catapult Your Career · 1. Chartered Financial Analyst (CFA) · 2. Financial Modeling & Valuation Analyst (FVMA) · 3. Chartered Financial Consultant®. Woman working at table. Best For. Financial professionals desiring comprehensive financial planning knowledge. Timing. Certified Financial Planner (CFP): For general financial advice CFP's are the most versatile type of financial advisor, as they are able to help you on any. Common certifications for financial planners and investment advisors include the CFP (certified financial planner), CFA (chartered financial analyst), and ChFC. Top 5 accounting and finance certifications · 1. Certified Government Financial Manager · 2. CMA · 3. CPA · 4. Chartered Financial Analyst (CFA) · 5. Enrolled Agent. Canada, known for its robust financial sector, offers a wide array of prestigious courses and certifications that can propel individuals to new heights. Certified Financial Planner ® (CFP®) · Chartered Financial Analyst (CFA®) · Certified Management Accountant (CMA) · Certified Fund Specialist (CFS) · Chartered. The Certified Financial Planner (CFP) certification ranks among the most popular and highly respected professional designations financial advisors hold. Numerous finance certifications are available that help you become an expert in a finance career, and choosing the right one depends on your specialization and. Not all Certifications are Created Equal. There are many financial certifications in use in the Canadian financial services industry, so never select a. Chartered Financial Analyst - CFA · Certified Public Accountant - CPA · Certified Financial Planner - CFP · Financial Risk Manager - FRM · Certified Investment. These include Certified Financial Planner (CFP), and Chartered Financial Analyst (CFA). Also, Chartered Financial Consultant (ChFC), and Certified Public. Certified Financial Planning (CFP) CFP certification can take your accounting career to the next level. Explore how to become a Best Finance Programs. The next most frequent certification is the Certified Government Financial A comprehensive list of the top certifications requested in job postings for each. 1. CFA Certification: 2. Certified Financial Planner (CFP) 3. Certified Public Accountant (CPA) 4. Chartered Alternative Investment Analyst (CAIA). Chartered Financial Analyst (CFA) certification is one of the most sought after professional credentials in finance but is the credential worth it? The CFA.

Purchase Series I Savings Bonds

/ten_thousand_dollar_series_i_savings_bonds-56a091253df78cafdaa2cb47.gif)

The interest is issued electronically to your designated account. You cannot buy more than $10, (face value) of Series EE bonds in any calendar year. If you. Series I bonds can end up paying a higher rate of interest than a Series EE bond, if you're willing to take the risk. Where Do You Buy Savings Bonds? Until a. In any single calendar year, you can purchase up to $5, of I bonds under this program. If you purchase bonds with your tax refund, the amount you request. How do I buy series EE bonds? These bonds are only available electronically, so in order to buy one you'll need to set up a TreasuryDirect account through. Series I Savings Bonds (often called I Bonds) are government savings bonds issued by the US Treasury that offer inflation protection. Series I, inflation-indexed savings bonds purchased from May through October , will earn a percent fixed rate of return above inflation. How to buy Series I bonds · Navigate to the TreasuryDirect website at fancyrobot.site · Click on "Open An Account." · Fill out an electronic account. Series HH bonds are no longer available for purchase. The U.S. government discontinued these bonds as of Aug. 31, Bonds that didn't mature continued to. Series I bonds are low-risk bonds that grow in value for up to 30 years. While you own them, they earn interest and protect you from inflation. The interest is issued electronically to your designated account. You cannot buy more than $10, (face value) of Series EE bonds in any calendar year. If you. Series I bonds can end up paying a higher rate of interest than a Series EE bond, if you're willing to take the risk. Where Do You Buy Savings Bonds? Until a. In any single calendar year, you can purchase up to $5, of I bonds under this program. If you purchase bonds with your tax refund, the amount you request. How do I buy series EE bonds? These bonds are only available electronically, so in order to buy one you'll need to set up a TreasuryDirect account through. Series I Savings Bonds (often called I Bonds) are government savings bonds issued by the US Treasury that offer inflation protection. Series I, inflation-indexed savings bonds purchased from May through October , will earn a percent fixed rate of return above inflation. How to buy Series I bonds · Navigate to the TreasuryDirect website at fancyrobot.site · Click on "Open An Account." · Fill out an electronic account. Series HH bonds are no longer available for purchase. The U.S. government discontinued these bonds as of Aug. 31, Bonds that didn't mature continued to. Series I bonds are low-risk bonds that grow in value for up to 30 years. While you own them, they earn interest and protect you from inflation.

Saving for retirement, protecting retirement income. Why invest with bonds with BMO? With BMO, you can purchase from three types of bonds. Each is low. The Payroll Savings Plan feature allows you to make recurring purchases of electronic Series EE and Series I Savings Bonds, funded by a payroll allotment. Series I U.S. Savings Bonds. To purchase electronic savings bonds and marketable securities, Please follow the instructions below to order paper savings bonds. The Payroll Savings Plan feature allows individual primary account-holders to make recurring purchases of electronic Series EE and Series I Savings Bonds. Series I bond is an interest-bearing U.S. government savings bond that earns a combined fixed interest and variable inflation rate (adjusted semiannually). They are redeemable only by the original purchaser, a recipient (for bonds purchased as gifts) or a beneficiary in case of the original holder's death. A $ In order to purchase or redeem a U.S. savings bond, an investor must bonds that can be purchased electronically are the Series EE and Series I bonds. Other types of non-marketable securities include Government Account Series, which can be purchased from Treasury by other federal agencies, and State and Local. People purchase U.S. savings bonds as an investment. It is also very common Series EE bonds. If the bonds you are looking for were issued before. If you're cashing in an electronic savings bond, log in to your TreasuryDirect account and use the link for cashing securities in ManageDirect. Savings bonds are simple, safe, and affordable loans to the federal government that can be purchased by individual investors. One way is to buy paper bonds with your tax refund. Using Form , you can buy anywhere from $50 to $5, worth of Series I bonds per person, per year. You. You buy savings bonds, and the government will pay you a certain rate of interest over the term of the bond. When the bond matures, you receive your principal. Log into your TreasuryDirect account and go to BuyDirect®. Click on the button next to the series of savings bond you wish to buy. Click Submit. On the “. Subpart C—Limitations on Annual Purchases. § Amounts which may be purchased. The amount of savings bonds of Series EE and HH which may be purchased. Buying Series I Savings Bonds. • Split your refund with direct deposits into two or three checking or savings accounts. • Receive your refund as a paper check. Available Bond Series and Denominations. Authorized military members and civilian employees may participate in the Voluntary Payroll Savings Plan to buy Series. The amount of savings bonds of Series I which may be purchased and held, in the name of any one person in any one calendar year, is computed according to the. The funds (principal and interest) in your Payroll Savings Plan are safe, guaranteed and will be honoured. Bond series in your plan will continue to earn. At 20 years, the bonds will be worth at least two times their purchase price. The bonds will continue to earn interest at their original fixed rate for an.

3 4 5 6 7