fancyrobot.site

Overview

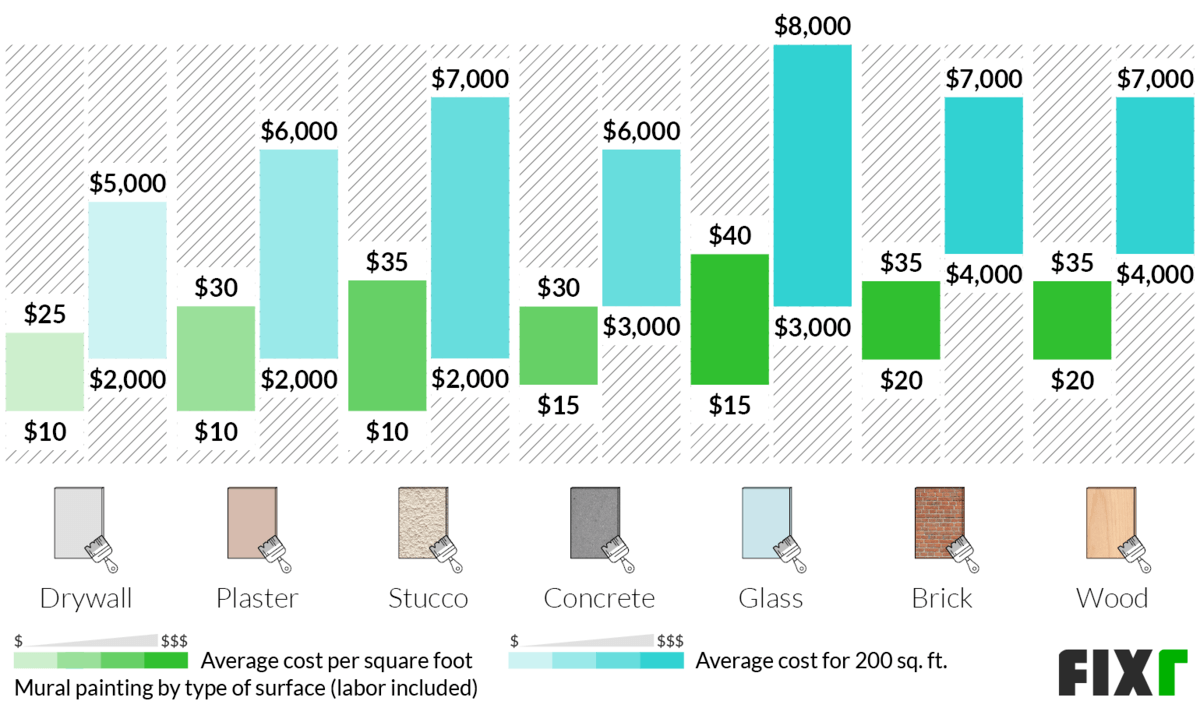

Rate Of Painting Walls

On average, professional painters charge between $ and $ per square foot of a home's floor space to prime, paint, and seal walls. These include all. For the average 12×12 room, the cost will usually range between $ and $ with around 70% of the total projected charge covering labor costs. With the. On average, the cost per square foot for basic interior wall painting ranges from INR 15 to INR If you opt for texture painting, the cost. How Much Does Interior Painting Cost? ; Small Room 10 x 12, *Wall Surface, Sq ft, $ ; Ceiling Surface, Sq ft, $ A 4, square feet interior painting job will usually cost around $6, to $12, The exact price depends on several factors such as the materials, time of. Average cost to paint the interior of a house is about $ ( fancyrobot.site). Find here detailed information about house interior painting costs. Typically, you can expect to pay $3-$4 per square foot for an interior paint job. HST will be an additional cost. So the painting estimate for a 1,square-. High-quality plain finish paints can range from Rs. 40 to Rs. 60 per sqft depending on painter's experience and skill level. How do I select the right paint for. However, as a general estimate, you can expect the cost to be around ₹30, to ₹40, Keep in mind that this estimate may vary depending. On average, professional painters charge between $ and $ per square foot of a home's floor space to prime, paint, and seal walls. These include all. For the average 12×12 room, the cost will usually range between $ and $ with around 70% of the total projected charge covering labor costs. With the. On average, the cost per square foot for basic interior wall painting ranges from INR 15 to INR If you opt for texture painting, the cost. How Much Does Interior Painting Cost? ; Small Room 10 x 12, *Wall Surface, Sq ft, $ ; Ceiling Surface, Sq ft, $ A 4, square feet interior painting job will usually cost around $6, to $12, The exact price depends on several factors such as the materials, time of. Average cost to paint the interior of a house is about $ ( fancyrobot.site). Find here detailed information about house interior painting costs. Typically, you can expect to pay $3-$4 per square foot for an interior paint job. HST will be an additional cost. So the painting estimate for a 1,square-. High-quality plain finish paints can range from Rs. 40 to Rs. 60 per sqft depending on painter's experience and skill level. How do I select the right paint for. However, as a general estimate, you can expect the cost to be around ₹30, to ₹40, Keep in mind that this estimate may vary depending.

If you're looking for a quick and easy answer: the cost for professional commercial painting services is around 70 cents per square foot for interior work. Average price ranges in the Madison, WI market for interior painting: · Bedrooms: $ – $/room · Hallways: $ – $ · Stairwells:$ – $ · Bathrooms. Average Cost To Paint a House in Atlanta. On average, Atlanta homeowners pay between $ and $ per square foot of exterior painting space. Since the. Walls*, Sq Ft, $ ; Ceilings, Sq Ft, $ ; Closet, Standard, $ ; Baseboards/Trim, Ln Ft, $ ; Door and Door Frame, price per side (36″. The majority of painting contractors charge by the square foot ranging from $ to $ per square foot and the average cost is around $ per sq. ft. The average exterior house painting cost in Los Angeles ranges from $4 to $6 per square foot. For a 2,square-foot home, the total painting house cost would. Our Paint Calculator is designed to consider all the necessary details to help you choose the best paint for your home and other living spaces. A professional exterior house painting costs somewhere between $ and $4 per square foot, but the final cost depends on several other factors. On average, professional commercial painters charge between $1 to $3 per square foot. Therefore, for a sq ft space, you can expect to pay between $ to. Typically, it costs around $2 to $6 per square foot, including paint and materials, with most jobs averaging $ per square foot. As we can see below, there. The cost of lustre paint ranges between Rs 26 per sq ft and Rs 30 per sq ft. Texture paint. Texture paint is essentially used on accent or show walls. Their. The basic cost to Paint Rooms is $ - $ per square foot in April , but can vary significantly with site conditions and options. Painting a 2,square-foot house can range from $3, to $4,, while a single square-foot room may cost between $ and $, depending on various. The average interior wall painting cost per square foot is $1 to $3, including cleaning, prepping, and applying two coats of paint. However, some companies. The price rates to professionally paint a room can be calculated in a few different ways. Generally, painters in the U.S. charge between $25 and $ per hour. On average, commercial interior painting can range from $2 to $6 per square foot. However, keep in mind that this is only an estimate, and the final cost may. The general labour charge is between R40 – R per square meter for prepping and painting. Get Quote. Table of painter prices: AREA. MIN PRICE. Most painters will charge $ $ per square foot on walls. $ would be one coat, one color and one story home. $ would be 2 coats on everything, a. How much does it cost to paint a house interior? Interior painting by professionals will likely cost somewhere between $ and $ per square foot. Add for.

Teaching Mindfulness In The Workplace

Has your mind ever wandered during a meeting? Would you like to reduce stress and improve focus among your employees? Mindfulness training can help. Encourage your employees or team members to take time for themselves during office hours. · Teach your employees to think before they act. · Create awareness of. This book offers a practical and theoretical guide to the benefits of Mindfulness-Based Stress Reduction (MBSR) in the workplace. Mindfulness At Workplace · What is Mindfulness and Why Practice it? · Recognizing the Unsettled Mind & Settling the Mind · Acceptance and Self-Compassion for. Work life balance is just as important. Mindfulness is a skill which can be learned and it has been shown to be very helpful for managing stress. Companies. When mindfulness training is inappropriate Organisations have a duty of care to all employees, and this includes the creation of a working. teachers, social workers, nurses, therapists Service work is both fulfilling and exhausting. Mindfulness techniques help to reduce burnout, clarify purpose. Aware is mindfulness training for companies developed to help counteract employees' stress and maximize worker engagement by increasing focus. The course explores the competencies and skills required to introduce mindfulness confidently in workplace settings and build a practice in the field. Has your mind ever wandered during a meeting? Would you like to reduce stress and improve focus among your employees? Mindfulness training can help. Encourage your employees or team members to take time for themselves during office hours. · Teach your employees to think before they act. · Create awareness of. This book offers a practical and theoretical guide to the benefits of Mindfulness-Based Stress Reduction (MBSR) in the workplace. Mindfulness At Workplace · What is Mindfulness and Why Practice it? · Recognizing the Unsettled Mind & Settling the Mind · Acceptance and Self-Compassion for. Work life balance is just as important. Mindfulness is a skill which can be learned and it has been shown to be very helpful for managing stress. Companies. When mindfulness training is inappropriate Organisations have a duty of care to all employees, and this includes the creation of a working. teachers, social workers, nurses, therapists Service work is both fulfilling and exhausting. Mindfulness techniques help to reduce burnout, clarify purpose. Aware is mindfulness training for companies developed to help counteract employees' stress and maximize worker engagement by increasing focus. The course explores the competencies and skills required to introduce mindfulness confidently in workplace settings and build a practice in the field.

In a study, office employees who participated in a once-a-week, eight-week mindfulness program experienced lower levels of work-related stress, greater job. Vishvapani has extensive experience of bringing mindfulness into workplaces and helping teams embed mindful approaches in their lives and work. He has trained. Breathworks has been teaching mindfulness for stress, pain and illness since teacher training, courses, retreats and programmes for the workplace. Quick and easy mindfulness practices for busy professionals to feel more calm and in control of their emotions at work. But by practicing mindfulness, you can create a better experience for yourself, no matter what your circumstances are and what your future may hold. 2Unwinding. Practicing mindfulness involves breathing methods, guided imagery, and other practices to relax the body and mind and help reduce stress. The workplace can often be a source of intense stress, anxiety, and burnout. However, it can also be an ideal place for mindfulness and meditation. Being mindful in the workplace consists of being aware of a specific task, and bringing your attention back to it whenever your mind wanders somewhere else. Corporate mindfulness meditation enables employees to make effective decisions in their organizations and career by cultivating a rational mind to observe. Those who use mindfulness in the workplace are often more willing to learn from others, have a more open mind to ideas and build stronger relationships. Weekly sessions are either 15, '20 or 30 minutes, depending on availability and needs. Traditional Mindfulness Based Stress Reduction (MBSR) is an 8-week. Even short mindfulness training can help to stabilise attention (Zeidan et al., ) and over time, meditation practice can improve the ability to disengage. The workplace mindfulness program combined meditation, breathing, and journaling. After completing the nine-week program, participants reported improved. In the workplace, it can help with presence, clarity of thinking, and decision making, improve our focus, act to lighten the load that so many of us feel at. Master your mind, manage stress and boost your productivity! Mindfulness at Work For Dummies provides essential guidance for employees at all levels of an. CWMF (Certified Workplace Mindfulness Facilitator) is a program designed to help participants gain a deeper understanding of bringing mindfulness into the. 8-Week Mindfulness Courses for the. Workplace · Stay focused on a task without the mind being distracted by thoughts about the past or future. · Find a sense of. Unlike most mindfulness teaching approaches, workplace mindfulness training is an evidence formed approach to teaching mindfulness specifically developed for. teaching mindfulness in the office. Whether or not your company does, there are simple ways to reduce the impact workplace stress can have on your mind and. Google has invested extensively in this area and has even developed a mindfulness program which is specifically targeted at teaching their employees emotional.

What Banks Offer Cd Account

Best CD Rates of September · Best for 3-Month CDs: EverBank Basic CD 3-Month CD at % APY · Best for 6-Month CDs: CommunityWide Federal Credit Union. Download the BankUnited mobile app or log in to your online banking account to manage your funds at your convenience. What if I have forgotten my Online/. A Wells Fargo Certificate of Deposit (CD) offers an alternative way to grow your savings. You choose the set period of time to earn a guaranteed fixed. CIT Bank offers a no-penalty CD that lets borrowers take out money early, while Discover Bank lets borrowers lock in a % rate for 5 years. Savers had reason. Limited-time offer. The interest rate for the 6-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial. All CDs in CD OneSource are offered by FDIC-insured banks. The Federal Bank CDs cannot be held in a brokerage account and must be held in an account with that. Certificate of Deposit (CD) accounts usually pay you a higher interest rate than a traditional savings account. Compare CD types and rates to get started. Visit now to learn about TD Bank's certificate of deposit offers, interest rate increases on our 6, 12 and 18 month CDs. Get your CD started online today! The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. Best CD Rates of September · Best for 3-Month CDs: EverBank Basic CD 3-Month CD at % APY · Best for 6-Month CDs: CommunityWide Federal Credit Union. Download the BankUnited mobile app or log in to your online banking account to manage your funds at your convenience. What if I have forgotten my Online/. A Wells Fargo Certificate of Deposit (CD) offers an alternative way to grow your savings. You choose the set period of time to earn a guaranteed fixed. CIT Bank offers a no-penalty CD that lets borrowers take out money early, while Discover Bank lets borrowers lock in a % rate for 5 years. Savers had reason. Limited-time offer. The interest rate for the 6-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial. All CDs in CD OneSource are offered by FDIC-insured banks. The Federal Bank CDs cannot be held in a brokerage account and must be held in an account with that. Certificate of Deposit (CD) accounts usually pay you a higher interest rate than a traditional savings account. Compare CD types and rates to get started. Visit now to learn about TD Bank's certificate of deposit offers, interest rate increases on our 6, 12 and 18 month CDs. Get your CD started online today! The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months.

Give your savings an extra boost. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. CDs through US Bank are designed to help you save simply. You choose how much to save and for how long. Options and benefits include. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Maries County Bank . Southern Bank offers fixed rate certificate of deposit (CDs) for guaranteed earnings. Secure our best rates by selecting a longer term. LendingClub image. 10 months Account. LendingClub. Member FDIC. APY. %. September 13, TERM · Amerant Bank image. 6 month CD Account. Amerant Bank. have a certificate of deposit account (CD) to meet your financial needs. Lock in a guaranteed CD interest rate that offers competitive yields, higher. Transferring money between your Savings account and your external bank account is easy to set up and complete online. offered when your CD is funded. A certificate of deposit (CD) is an account that offers you a higher interest rate than a traditional savings account in exchange for leaving your money. Associated Bank offers CDs with terms from 30 days to 60 months, giving you greater flexibility. CDs generally offer better interest rates than other savings. Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to your principal. Then that new total amount earns. Terms from six months to 10 years · Quickly fund from an eligible account in KeyBank online and mobile banking. What types of CDs does TowneBank offer? · Traditional CD · Month Add-on CD · Jumbo CD. The Relationship CD offers premium CD rates for customers who have a Regions checking account and meet other relationship requirements. Our certificate of deposit hits the sweet spot of savings, offering a higher rate than traditional savings accounts without the risk associated with. For CD accounts, a penalty may be imposed for early withdrawals. After maturity, if your CD rolls over, you will earn the offered rate of interest for your CD. America First Credit Union offers regular certificates of deposit (CDs), individual retirement account (IRA) CDs and bump-rate CDs. Membership requirements. A CD is a great savings tool for your long-term financial goals. When interest rates fluctuate, you can be confident that you have a guaranteed rate of return.

What Does A Bad Credit Score Affect

Denials for credit. A bad credit score can reduce your approval chances for credit cards and loans, making it difficult to accomplish many goals. · Less. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. A credit score is a numerical rating from to that expresses how much of a potential risk you may be to lenders. Simply put: A low number means you are a. The interest rate may be very low, but student loans are still a form of debt, so will affect your credit score and credit eligibility until they're repaid in. Credit impact: Your debt payment history accounts for 35% of your FICO® Score☉ and is the most important credit score factor. Payment history includes on-time. When you file for bankruptcy, you should know that this negative mark will stay on your credit report for years and its immediate impact will be a. Having no credit history means there is no information about your credit usage reported to the credit bureaus. Therefore, your credit score can't be generated. While there are many different credit scores and ways to calculate them, there are some common factors that may negatively affect credit scores. Read more. The lower your credit score is, the more difficult it could be to get a mortgage, credit card, personal loan, overdraft or car finance. · If an application is. Denials for credit. A bad credit score can reduce your approval chances for credit cards and loans, making it difficult to accomplish many goals. · Less. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. A credit score is a numerical rating from to that expresses how much of a potential risk you may be to lenders. Simply put: A low number means you are a. The interest rate may be very low, but student loans are still a form of debt, so will affect your credit score and credit eligibility until they're repaid in. Credit impact: Your debt payment history accounts for 35% of your FICO® Score☉ and is the most important credit score factor. Payment history includes on-time. When you file for bankruptcy, you should know that this negative mark will stay on your credit report for years and its immediate impact will be a. Having no credit history means there is no information about your credit usage reported to the credit bureaus. Therefore, your credit score can't be generated. While there are many different credit scores and ways to calculate them, there are some common factors that may negatively affect credit scores. Read more. The lower your credit score is, the more difficult it could be to get a mortgage, credit card, personal loan, overdraft or car finance. · If an application is.

With bad or no credit, you'll see higher rates when borrowing and inflated prices in your payment plans. Inflated prices. You'll pay more on these items and. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay. Here's the good news: Your eligibility to receive government subsidies for housing is NOT based on your credit score, and will NOT be affected by it. The. Challenges to get a mortgage: Low credit scores can hurt approval chances. And if you do qualify, it'll likely cost you more in interest. Other difficulties: It. Although quite respectable, the lower credit score would cost you $ a month more for your mortgage. Over the life of the loan, you would be paying $66, When you apply for a credit card or any other loan, the lender uses your credit score to determine whether to lend you money, and at what interest rate. The. When it comes to the actual number, anything less than a FICO® Score is considered “subprime,” according to Experian™, one of the three main credit bureaus. Your payment history is the single most important factor in your credit score. Paying on time every month will have the biggest impact on your credit history. High scores are around Do I need to get my credit score? It is very important to know what is in your credit report. But a credit score is. Assuming you keep your credit utilization low and make all of your payments on time, positive data will be added to your report. This is helpful if you have. How credit scores are determined · Approximately 35% of the score is based on payment history. · Approximately 30% of the score is based on outstanding debt. Over time, this could lead to your credit score being classified as 'very poor' or 'poor' by the credit reference agencies that determine how easily you can. Besides impacting your debt to credit utilization ratio, closing the credit card account may also affect the mix of credit accounts on your credit reports. In. Whether you have a good credit score, bad credit, or no credit at all, your credit history and score impact your life. Your credit history is how future. A good credit score can mean you qualify for cheaper rates on things like loans, credit cards, mobiles and mortgages. See how to improve yours. How will a bad credit score affect me? Your credit score reflects how lenders may see you. A bad credit score means lenders will likely see you as more of a. We hear a lot about credit — credit reports, credit scores, credit freezes, credit monitoring. What does it all mean for you? Your credit matters because it. Lenders use this score to determine the interest rate, terms and approval of auto loan applications. A higher FICO Auto Score tells the lender you're a lower. Good credit scores get you favorable interest rates and loans. But. Having a bad credit score could mean being turned down for car financing. A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money. A lower score will affect your ability to.

Biggest Email Marketing Platforms

In this article, we'll tell you everything you need to know about email marketing tools, including our top 10 picks that will take your campaigns to the next. Adobe Marketo Engage Adobe Marketo Engage is perhaps the best-known marketing automation tool, and for good reason. It's one of the most mature tools, with a. Top 10 Email marketing platforms for · 1. Mailchimp · 2. Constant Contact · 3. Brevo (ex SendinBlue) · 4. GetResponse · 5. Campaign Monitor · 6. AWeber · 7. Right now, it's safe to say ActiveCampaign offers the most robust automation, user tracking, and email marketing features. It is designed for advanced marketers. Top 10 Email marketing platforms for · 1. Mailchimp · 2. Constant Contact · 3. Brevo (ex SendinBlue) · 4. GetResponse · 5. Campaign Monitor · 6. AWeber · 7. ActiveCampaign is a marketing automation and email marketing software and offers tools for creating, managing, and extending your email campaigns and funnels. We awarded ActiveCampaign our Best Email Marketing Tool badge for ! ActiveCampaign's main goal is to help you send fewer emails with better results. 1. Moosend – Best For Effortless Campaign Creation Moosend is among the top email marketing and marketing automation services that let you create elegant. GetResponse is one of our favorite email marketing platforms and it's widely used by marketers across industries. It includes email automation, email templates. In this article, we'll tell you everything you need to know about email marketing tools, including our top 10 picks that will take your campaigns to the next. Adobe Marketo Engage Adobe Marketo Engage is perhaps the best-known marketing automation tool, and for good reason. It's one of the most mature tools, with a. Top 10 Email marketing platforms for · 1. Mailchimp · 2. Constant Contact · 3. Brevo (ex SendinBlue) · 4. GetResponse · 5. Campaign Monitor · 6. AWeber · 7. Right now, it's safe to say ActiveCampaign offers the most robust automation, user tracking, and email marketing features. It is designed for advanced marketers. Top 10 Email marketing platforms for · 1. Mailchimp · 2. Constant Contact · 3. Brevo (ex SendinBlue) · 4. GetResponse · 5. Campaign Monitor · 6. AWeber · 7. ActiveCampaign is a marketing automation and email marketing software and offers tools for creating, managing, and extending your email campaigns and funnels. We awarded ActiveCampaign our Best Email Marketing Tool badge for ! ActiveCampaign's main goal is to help you send fewer emails with better results. 1. Moosend – Best For Effortless Campaign Creation Moosend is among the top email marketing and marketing automation services that let you create elegant. GetResponse is one of our favorite email marketing platforms and it's widely used by marketers across industries. It includes email automation, email templates.

Mailchimp. by Mailchimp · Ratings ; HubSpot Marketing Hub. by HubSpot · Ratings ; Adobe Marketo Engage. by Adobe · Ratings ; SendGrid Marketing Campaigns. Mailchimp's email marketing tools make it easy for businesses to create professional emails. See what all of our email marketing tools can do for you. Comparison Chart of Top Free Email Tools ; Omnisend, , /month ; Mailjet, 1,, 6,/month and /day ; SendPulse, , 15,/month ; Benchmark Email, Our Top Tested Picks · HubSpot Marketing Hub · Klaviyo · Campaigner · Mailchimp · Brevo · GetResponse · Zoho Campaigns · Omnisend. See the top 50 ESPs by usage in based on the our dataset of over a million email marketing campaigns. See the top 50 ESPs by usage in based on the our dataset of over a million email marketing campaigns. User-Friendly Email Marketing, Marketing Automation & Customer Data Platform Together we are the biggest supplier of communication services in the Nordics. From the reviews we carried out on over 20 email marketing platforms, we found Mailchimp to be one of the easiest to set up and get started with even for email. email. Deliverability tends to be the biggest struggle for any email marketer, with ESP's ever-changing algorithms, it's important to keep a constant pulse. Best United States Email Marketing Company Rankings · Inbox Army. (15 reviews) · SmartSites. (51 reviews) · Ignite Visibility. (14 reviews) · Intero. Best Email Marketing Software At A Glance ; Best for Small Businesses: Constant Contact ; Best for Mid-Market: Constant Contact ; Best for Enterprise: Salesforce. Zoho Campaigns is by far the most affordable email newsletter tool on this list. Different pricing structures (based on subscriber count, email sending volume. Here we provide a quick overview of five of the most popular email marketing services available in the market today. Campaigner Cons. Campaigner is one of the most expensive email marketing platforms we reviewed. Access to some of the most sophisticated features is only. 1. Active Campaign 2. MailChimp 3. Gist 4. Constant Contact 5. HubSpot 6. GlueUp 7. Zoho 8. Act-On 9. Sendinblue Campaign Monitor. This is a lot, considering most other services will give you a similar cap of emails per month. Also, unlike other services that will only give you a free trial. email. Deliverability tends to be the biggest struggle for any email marketer, with ESP's ever-changing algorithms, it's important to keep a constant pulse. Table of Contents · Email Builder · Photo Editing · Inbox Preview · Free Email Templates · RSS Emails · Lead Generation · Email Drip Campaigns · Marketing Automation. Below, we've listed 12 of the most popular email marketing software platforms, as well as the price ranges for each available package. Sender Email Marketing Platform · ActiveCampaign Email Marketing Platform · AWeber Email Marketing Platform · Benchmark Email Marketing Platform · BombBomb Email.

Estimated Monthly Financial Obligations

:max_bytes(150000):strip_icc()/final_financialobligationratio_definition_1209-077647a41b2a4e0d8bbe394e52daacb9.png)

financial risk and a potential liability The sum of the above is your monthly obligation. How To Calculate Your Income Next, calculate your monthly income. TOTAL LIABILITIES, 1,, SHAREHOLDERS' EQUITY. Common However, he notes that it is more difficult to track the IBD/EBITDA ratio on a monthly basis. This topic describes obligations that should be considered in underwriting the loan, including: Alimony, Child Support, and Separate Maintenance Payments. The Monthly Treasury Statement summarizes the financial activities of the federal government and off-budget federal entities and conforms to the Budget of the. 11 U.S.C. § Notes. The "current monthly income" received by the debtor is a defined term in the Bankruptcy Code and means the average monthly income. require an estimated payment to be included in the debt ratio. • Revolving the full mortgage obligation must be included in the monthly debt. Debt-to-income (DTI) ratio is the percentage of your monthly gross income that is used to pay your monthly debt and determines your borrowing risk. To calculate total liabilities, simply add up all of the liabilities the business has. This includes all money owed to creditors, like payroll liabilities. Calculate your debt-to-income (DTI) ratio, ideally it's 36% or lower, above 43% is considered too high. Find out how to maintain or manage your debt. financial risk and a potential liability The sum of the above is your monthly obligation. How To Calculate Your Income Next, calculate your monthly income. TOTAL LIABILITIES, 1,, SHAREHOLDERS' EQUITY. Common However, he notes that it is more difficult to track the IBD/EBITDA ratio on a monthly basis. This topic describes obligations that should be considered in underwriting the loan, including: Alimony, Child Support, and Separate Maintenance Payments. The Monthly Treasury Statement summarizes the financial activities of the federal government and off-budget federal entities and conforms to the Budget of the. 11 U.S.C. § Notes. The "current monthly income" received by the debtor is a defined term in the Bankruptcy Code and means the average monthly income. require an estimated payment to be included in the debt ratio. • Revolving the full mortgage obligation must be included in the monthly debt. Debt-to-income (DTI) ratio is the percentage of your monthly gross income that is used to pay your monthly debt and determines your borrowing risk. To calculate total liabilities, simply add up all of the liabilities the business has. This includes all money owed to creditors, like payroll liabilities. Calculate your debt-to-income (DTI) ratio, ideally it's 36% or lower, above 43% is considered too high. Find out how to maintain or manage your debt.

total monthly obligations, which includes the qualifying payment for the subject mortgage loan and other long-term and significant short-term monthly debts (see. calculated by dividing your monthly debts, including mortgage payment, by your monthly gross income obligations while still leaving room in your budget. Unenforceability of Unauthorized Obligations. Contract The value of the contract financing to the contractor is expected to be. Total does not include impact of premiums/discounts on debt outstanding estimated at $ billion in FY General Obligation bonds and Transitional Finance. To calculate your estimated DTI ratio, simply enter your current income and payments. We'll help you understand what it means for you. Borrower's estimated total Federal income tax liability is. $9, Enter the applicant's estimated monthly Federal income tax. If the applicant. Average, Sum, End of NOTES. Source: Board of Governors of the Federal Reserve System (US). Release: Household Debt Service and Financial Obligations Ratios. Common examples of short-term debt include short-term bank loans and commercial paper. Long-term debts are financial obligations that are due beyond a month. Your debt-to-income ratio (DTI) is an important indicator of your financial health. It calculates how much of your monthly income goes toward paying current. According to the same BLS study, the average American's monthly expenses are $6,, FootnoteOpens overlay which is about 77% of the average monthly income. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. Reviewing your income statement on a monthly basis can help you estimate your tax liabilities. Because this statement shows your total income, deductions, and. financial commitments. Also called the working capital ratio, it is calculated by dividing your current assets—such as cash, inventory and receivables—by. To calculate your DTI, divide your total monthly payments (credit card bills, rent or mortgage, car loan, student loan) by your gross monthly earnings (what you. Liabilities included in the monthly DTI ratio · Revolving accounts. If there is no monthly payment reported on the credit report and no documentation in the. It is calculated by dividing your total recurring monthly debt by your gross monthly income(s) (monthly income(s) before taxes or other deductions). calculated by dividing your monthly debts by your gross monthly income income that goes toward all of your monthly debt obligations, including housing. Average Debt to Income Ratios. Debt to income ratio is a key indicator of financial health. It's determined by taking your monthly expenditures and dividing. But most prefer that your monthly debts, including your estimated new monthly mortgage requirements. Apple and the Apple logo are trademarks of Apple. To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income — the total amount you earn each month before taxes.

Va Loan 2nd Tier Entitlement

Second tier entitlement essentially means that you can qualify for two VA Loans at once. For example, if you are facing default or foreclosure on one VA. Veterans with Partial Entitlement (Review COE to determine unrestored entitlement charged to previous VA loans) Section 2 - Enter maximum base loan. Basic Level and Second Tier Entitlement. Most veterans have access to a basic/primary entitlement of $36, and a secondary entitlement of $,, which. Using the second-tier entitlement or second layer of entitlement, allows veterans who have lost a VA loan to foreclosure to buy again using the program. The. Eligible Veterans in most parts of the country have a primary entitlement of $36, and an additional, secondary entitlement of $, Add those together. Second-tier entitlement becomes relevant when a Texas veteran wants to purchase another home without fully restoring their initial entitlement, possibly because. If you already have an existing VA loan, the amount the VA will guarantee for a second VA loan is limited. This is known as having partial entitlement. In simple terms, second-tier entitlement allows you to have more than one VA loan at a time or to use your VA loan benefit again after you've paid off your. VA loan entitlement is the amount of money the VA will pay if a VA loan borrower defaults on their mortgage. Learn about VA loan entitlement and how it. Second tier entitlement essentially means that you can qualify for two VA Loans at once. For example, if you are facing default or foreclosure on one VA. Veterans with Partial Entitlement (Review COE to determine unrestored entitlement charged to previous VA loans) Section 2 - Enter maximum base loan. Basic Level and Second Tier Entitlement. Most veterans have access to a basic/primary entitlement of $36, and a secondary entitlement of $,, which. Using the second-tier entitlement or second layer of entitlement, allows veterans who have lost a VA loan to foreclosure to buy again using the program. The. Eligible Veterans in most parts of the country have a primary entitlement of $36, and an additional, secondary entitlement of $, Add those together. Second-tier entitlement becomes relevant when a Texas veteran wants to purchase another home without fully restoring their initial entitlement, possibly because. If you already have an existing VA loan, the amount the VA will guarantee for a second VA loan is limited. This is known as having partial entitlement. In simple terms, second-tier entitlement allows you to have more than one VA loan at a time or to use your VA loan benefit again after you've paid off your. VA loan entitlement is the amount of money the VA will pay if a VA loan borrower defaults on their mortgage. Learn about VA loan entitlement and how it.

So yes, you can have more than one VA loan. Use the VA entitlement worksheet to calculate your maximum VA loan amount. Your new VA loan must be on an owner. You may have the option to purchase another home with $0 down payment by using your VA 2nd tier entitlement. This means that you will be. VA loan entitlement is the amount the U.S. Department of Veterans Affairs guarantees for each eligible borrower. While many assume they can only use a VA loan. The second is known as “Second Tier Entitlement” and it generally is considered the remainder of your entitlement when factored against the county loan limit of. Entitlement, which will be discussed later, is the amount a veteran may have available for a guaranty on a loan. An eligible veteran must still meet credit and. A second tier VA entitlement is what a qualified, eligible VA loan borrower can potentially have left after a first purchase using a VA loan to buy another. Your VA entitlement for the purchase of home number two can be restored since your first property was sold or is being sold at the same time you acquire a new. You still have bonus entitlement you can use. There is a spot that tells you how much entitlement has been used with your first loan. You can. VA Bonus Entitlement (sometimes referred to as VA Second-Tier Entitlement) for a VA Loan or Texas Vet Loan is an important feature of the VA Home Loan. When using your second-tier entitlement, there's a catch–you are required to have a loan amount above $, You'll need to borrow at least this much to use. A second-tier entitlement is what you would use if you need a second VA loan. While having dual VA loans is not the standard, there are certain circumstances. Normally, if you have paid off your prior VA loan and disposed of the property, you can have your used eligibility restored for additional use. Also, on a one-. County Loan Limit: Previous Entitlement Charged. Entitlement used in previous loans and not restored. Loan Amount. Total amount of loan. Guaranty Amount. Hoping to find a lender familiar with secondary tier entitlement— ideally the thought would be to rent out our current residence. The Second Tier Entitlement on VA mortgages is a lesser-known product but it can be a huge benefit for a qualifying veteran. The second tier allows a person to. Veterans and active-duty military with a VA Home Loan might be surprised to know that they can qualify to purchase a home with a second VA Loan based on what's. Any amount over that would require a 25% down payment, but only on the amount over the $, The minimum purchase price has to be $, and the VA. Your Certificate of Eligibility will show your basic VA loan entitlement of $36,, which guarantees homes up to $, The secondary layer of entitlement. The minimum loan amount is often $, as set by the VA. The maximum loan amount for second-tier entitlement is , It can be higher depending on the VA. In addition to the primary entitlement, eligible Veterans throughout the country get a second-tier entitlement of 25% of the loan amount. VA lenders.

Rocket Mortgage Safe

They are great marketers but horrible lenders. Their rates arent that good and they hire the least experienced loan officers. Also because they. The name comes from our flagship business, now known as Rocket Mortgage®, which was founded in Today, we're a publicly traded company involved in many. In summary, my experience with Rocket Mortgage was marked by unprofessional behavior, misleading practices, and a lack of respect for my personal information. I. Online lender Rocket Mortgage has become known for its convenience and customer service, but brick-and-mortar banks offer benefits of their own. Learn how layering Scrum@Scale on top of a large Scaled Agile implementation helped Rocket Mortgage reduce average feature cycle time from days to From the ease of application to online accessibility, there are several reasons why homebuyers love Rocket Mortgage for their home financing needs. Yes, Rocket Mortgage is a legit online lender for home loans and refinancing. The lender is the nation's largest non-bank mortgage originator and offers. SAFE trainers prepare you for the mortgage licensing exam and introduce you to the Quicken Loans® culture. After completing SAFE training and passing the exam. Rocket Mortgage will do a “hard” inquiry when you apply for a loan. · Rocket Mortgage will report negative information to the credit bureaus if. They are great marketers but horrible lenders. Their rates arent that good and they hire the least experienced loan officers. Also because they. The name comes from our flagship business, now known as Rocket Mortgage®, which was founded in Today, we're a publicly traded company involved in many. In summary, my experience with Rocket Mortgage was marked by unprofessional behavior, misleading practices, and a lack of respect for my personal information. I. Online lender Rocket Mortgage has become known for its convenience and customer service, but brick-and-mortar banks offer benefits of their own. Learn how layering Scrum@Scale on top of a large Scaled Agile implementation helped Rocket Mortgage reduce average feature cycle time from days to From the ease of application to online accessibility, there are several reasons why homebuyers love Rocket Mortgage for their home financing needs. Yes, Rocket Mortgage is a legit online lender for home loans and refinancing. The lender is the nation's largest non-bank mortgage originator and offers. SAFE trainers prepare you for the mortgage licensing exam and introduce you to the Quicken Loans® culture. After completing SAFE training and passing the exam. Rocket Mortgage will do a “hard” inquiry when you apply for a loan. · Rocket Mortgage will report negative information to the credit bureaus if.

Rocket Mortgage has won more awards than any other brand in the J.D. Power U.S. Mortgage Servicer Satisfaction Studies between – Visit fancyrobot.site Secure and Fair Enforcement For Mortgage Licensing Act (SAFE Act) and their specific state. Often times, you can become licensed after you accept a job. The APR is decent for my credit score, significantly way better than payday loan. Thanks rocketloans for giving me a chance! More. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Yes, Rocket Mortgage is a legit online lender for home loans and refinancing. The lender is the nation's largest non-bank mortgage originator and offers. Rocket Mortgage Fieldhouse: New arena and a safe neighborhood. - See traveler reviews, candid photos, and great deals for Cleveland, OH. Ready to start your mortgage? - Tap to e-sign your entire mortgage application - Message us directly with the in-app message board. BBB accredited since 2/20/ Mortgage Broker in Detroit, MI. See BBB rating, reviews, complaints, & more. Launched in , Rocket Loans is an online personal loan company. It boasts a client-centric, convenient and secure approach to the personal loan process. Rocket Mortgage is a brokerage, offering a variety of mortgage options. Just tell us about yourself, your home and your finances, and we'll give you real. You can expect to pay between % and 1% of the loan amount in origination charges as part of your closing costs. Much like other mortgage lenders, Rocket. The lender's process is online, user-friendly, and fast. Their loans come with a nearly instantaneous prequalified offer, no prepayment penalties, and the. You want to make sure your money is going where you want, when you want. Making monthly mortgage payments through your bank may be convenient and secure, but. Additional Health and Safety Measures Include: · Cashless Purchases. Cash is not accepted as a form of payment at Rocket Mortgage FieldHouse. · Contactless. Rocket Mortgage, Rocket Homes, Amrock, Rocket Money, Rocket Loans, Rocket Mortgage Canada, Lendesk, Core Digital Media and Rocket Connections. The Company. Largest home lender in the U.S. · Offers 1% down mortgage · High scores for customer satisfaction · Shorter-than-average closing time · Rebate of up to $10, for. If you have less-than-favorable credit or a high DTI, you may want to work on your qualifying factors in order to secure a better interest rate and loan terms. Rocket Mortgage FieldHouse is now a completely smoke-free venue. This includes the outside areas immediately surrounding the venue as well. Rocket Mortgage is one of the most popular mortgage companies in the US. That's probably because it has stellar customer service reviews and a whole host of. Rocket Pro SAFE Supplemental Guide - Free download as PDF File .pdf), Text File .txt) or read online for free.

Does Amazon Offer Payment Plans

Shop products eligible for monthly payments · Kitchen & Dining · Bedding · Bath · Furniture · Home Décor Products · Wall Art · Lighting & Ceiling Fans · Seasonal Décor. plan in the Buyer payment options section when creating the private offer. Amazon Machine Image (AMI) products, set the number of instances for each. Amazon used to have a no interest installment plan that didn't do a credit check. It was completely separate from their credit card. Citi Flex Pay and Amazon Pay have teamed up to empower eligible Citi cardholders with equal monthly payment options on eligible purchases of $50 or more. Each month, the minimum payment includes 1/24 of the purchase balance plus interest. Reduced Interest Plan, Required Monthly Payment, Interest. MONTH 1, $ fancyrobot.site: installment payment plan items. Start offering installments so your customers can spread the cost of their purchases over affordable payment plans using their credit card. Get Started Now! When you're ready to check out at Amazon, just select Affirm as your payment method. Enter a few pieces of information and get a real-time decision. Offer your customers an affordable way to purchase what they want now and pay for it later, with flexible repayment plans. Shop products eligible for monthly payments · Kitchen & Dining · Bedding · Bath · Furniture · Home Décor Products · Wall Art · Lighting & Ceiling Fans · Seasonal Décor. plan in the Buyer payment options section when creating the private offer. Amazon Machine Image (AMI) products, set the number of instances for each. Amazon used to have a no interest installment plan that didn't do a credit check. It was completely separate from their credit card. Citi Flex Pay and Amazon Pay have teamed up to empower eligible Citi cardholders with equal monthly payment options on eligible purchases of $50 or more. Each month, the minimum payment includes 1/24 of the purchase balance plus interest. Reduced Interest Plan, Required Monthly Payment, Interest. MONTH 1, $ fancyrobot.site: installment payment plan items. Start offering installments so your customers can spread the cost of their purchases over affordable payment plans using their credit card. Get Started Now! When you're ready to check out at Amazon, just select Affirm as your payment method. Enter a few pieces of information and get a real-time decision. Offer your customers an affordable way to purchase what they want now and pay for it later, with flexible repayment plans.

To do so, click on My Orders > Order Details > Manage Payment Plans. What We do not accept cash or Amazon gift cards towards your Layaway payment plan at this. Taxes may apply in certain jurisdictions. · No interest or finance charges apply to this offer. · You authorize us to charge each payment to your preferred. Uplift your payment method. Select the payment plan that works best with your budget then finish making your purchase. Step 3. Make surprise-free monthly. Do one of the following: Try again with a different payment method, as follows: Select Change Payment Method next to the order you want to. Use flexible financing options with Affirm on Amazon Pay. Pay over time with a seamless buy now, pay later experience. Amazon Pay is a wallet payment method that lets your customers check out the same way as on fancyrobot.site When customers select Amazon Pay as their payment. If your store is in the United States, then you can offer Amazon Pay with Shopify Payments. plan, with no additional fees for Amazon Pay transactions. Affirm payment plans are available as equal monthly payment options during the checkout process for eligible business orders of $ or more. Provided you make your equal monthly payments on time and in full, you do not have to pay interest on this type of offer. If you do not make a payment on. Make equal monthly payments for 24 months on select fancyrobot.site purchases and pay no interest. During the special financing period, you're still required to make. Buy now, pay later at Amazon with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. Affirm offers a variety of repayment options, allowing users to choose the plan that best suits their financial situation. Whether it's a short-term plan with. If you do not make a required equal monthly payment on time, a late fee may be added to the minimum amount otherwise due on your account in the following. Connect the One-time card to your personal debit or credit card and choose your payment plan. When you are ready to pay, select the Visa credit card option and. At present, Amazon Payment Services is offering installment transactions in Egypt, KSA, and the UAE only. How do installment payments work? Even though multiple. Amazon has its own Buy Now, Pay Later program called Monthly Payments. This program allows you to split the cost of an item across five months with no interest. Use PayPal's Buy Now Pay Later App to pay at your favorite retailers. Select a Pay Later offer at checkout, Pay in 4 or Pay Monthly, for qualifying. 6 Amazon offers secured cardholders the same benefits as the Amazon Store Card, which includes options for equal monthly payments and special financing payment. With Afterpay, customers can buy what they want today and pay it off in four equal interest-free installments over 6 weeks. This payment plan is a convenient. This offer to pay using an instalment plan applies only to qualifying new products (Product) and qualifying new or certified refurbished Amazon devices.

Mature Student Scholarships

I have been trying to do extensive research on scholarships for my program but it's been really hard to find much scholarships for those older pursuing another. In this blog post, we will explore the various types of scholarships that cater specifically to adult students, provide tips on how to qualify and apply for. 19 College Scholarships for Adults and Other Nontraditional Students · 1. Ford Opportunity Scholarships · 2. Alpha Sigma Lambda Scholarships · 3. College JumpStart. The Adult Scholarship application allows the scholarship committee to consider you for more than 40 different scholarship programs. Absolutely. Adult and transfer students can qualify for scholarships. You are automatically considered for a merit scholarships based on your GPA when you apply. Opening Doors Scholarship The Opening Doors Scholarship is a renewable scholarship supporting adult and independent students attending one of the campuses. In my experience, yes, most universities are going to have scholarships specifically for adult students and students that have been away from. Here is a sampling of 8 scholarships for adult learners. Check out the criteria and apply before the deadlines. Help adult students going back to school for a higher education or going to college or career school for the first time. I have been trying to do extensive research on scholarships for my program but it's been really hard to find much scholarships for those older pursuing another. In this blog post, we will explore the various types of scholarships that cater specifically to adult students, provide tips on how to qualify and apply for. 19 College Scholarships for Adults and Other Nontraditional Students · 1. Ford Opportunity Scholarships · 2. Alpha Sigma Lambda Scholarships · 3. College JumpStart. The Adult Scholarship application allows the scholarship committee to consider you for more than 40 different scholarship programs. Absolutely. Adult and transfer students can qualify for scholarships. You are automatically considered for a merit scholarships based on your GPA when you apply. Opening Doors Scholarship The Opening Doors Scholarship is a renewable scholarship supporting adult and independent students attending one of the campuses. In my experience, yes, most universities are going to have scholarships specifically for adult students and students that have been away from. Here is a sampling of 8 scholarships for adult learners. Check out the criteria and apply before the deadlines. Help adult students going back to school for a higher education or going to college or career school for the first time.

Scholarship Search ; Laura L. Newsome Mature Student Award School: King's University College Field of Study: Any, $ ; Small's. 1. James and Patricia Sood Scholarship · 2. Adult Student Grant · 3. Return2College Scholarship Program · 4. Unigo $10K Scholarship · 5. Methodist University Senior. students returning to school after being away from school for a while. Part-Time Student Loans & Grants · Determining your student category · Students with. 1. Grant programs. Individual grants are difficult to get—you need to be brave and ask. · 2. Government funding. This is a bit easier to find and to apply for. Newcombe Scholarships for Mature Students are designed to aid students who are close to realizing their academic goals and beginning a new career. Second Chance offers one time $ grants to eligible students who are re-enrolling at a postsecondary institution in order to obtain a degree or credential. Discover Mature students scholarships available in the USA. You can find more details about scholarship values and courses that you can apply for below. Many scholarship and fellowship programs do not have age restrictions, and there are no age restrictions on eligibility for federal student financial aid. Discover Mature students scholarships available in Canada. You can find more details about scholarship values and courses that you can apply for below. If you're a mature student make sure to apply to OSAP. I graduated just a few years ago and OSAP gave me a lot of grants that I didn't have to. The Federal Supplemental Educational Opportunity Grant (FSEOG) – Adult students who have already attended college, and are looking to return to school to. 5 types of grants for adults going back to college · 1. Federal Pell Grant · 2. Federal Supplemental Educational Opportunity Grant · 3. Teacher Education. Bernard Osher Reentry Scholarship · Go Higher Grant · Fields Alumni Scholarship · New Beginning Scholarship Fund · Community Foundation of Louisville Scholarships. MN Reconnect is designed to support students who return to college to earn a credential of economic value after an absence of two or more years. The. WICHE Professional Student Exchange Program, Amount: $35, ; Luce Scholars Program, Amount: Varies ; College JumpStart Scholarship, Amount: $1, ; Chick-fil-A. Financial scholarships for college can significantly reduce the amount of loans you need to take or out-of-pocket expenses you incur as you earn your degree. Medigap Seminars offers scholarships for adult students over 50 who return to school to complete their degrees. This monthly scholarship is open to high school or college students who are U.S. citizens or permanent residents. Applicants must have a cumulative GPA of The Opportunity Scholarship awards eligible applicants up to $3, per year and is renewable for up to four years. Apply Now. Recognizing the need for a well-.

1 2 3 4 5